At the beginning of 2026, the crypto market is experiencing "a tale of two extremes." On one side, the overall market is repeatedly fluctuating; on the other, the RWA sector is bucking the trend, showing a resilient rebound and gradually reaching a critical juncture for industry transformation. This is not a short-term, stimulus-driven surge but the result of gradually clearer policy boundaries, continuous institutional investment, and the maturation of underlying infrastructure since 2024. It also marks the RWA sector's transition from the conceptual validation phase to true large-scale implementation.

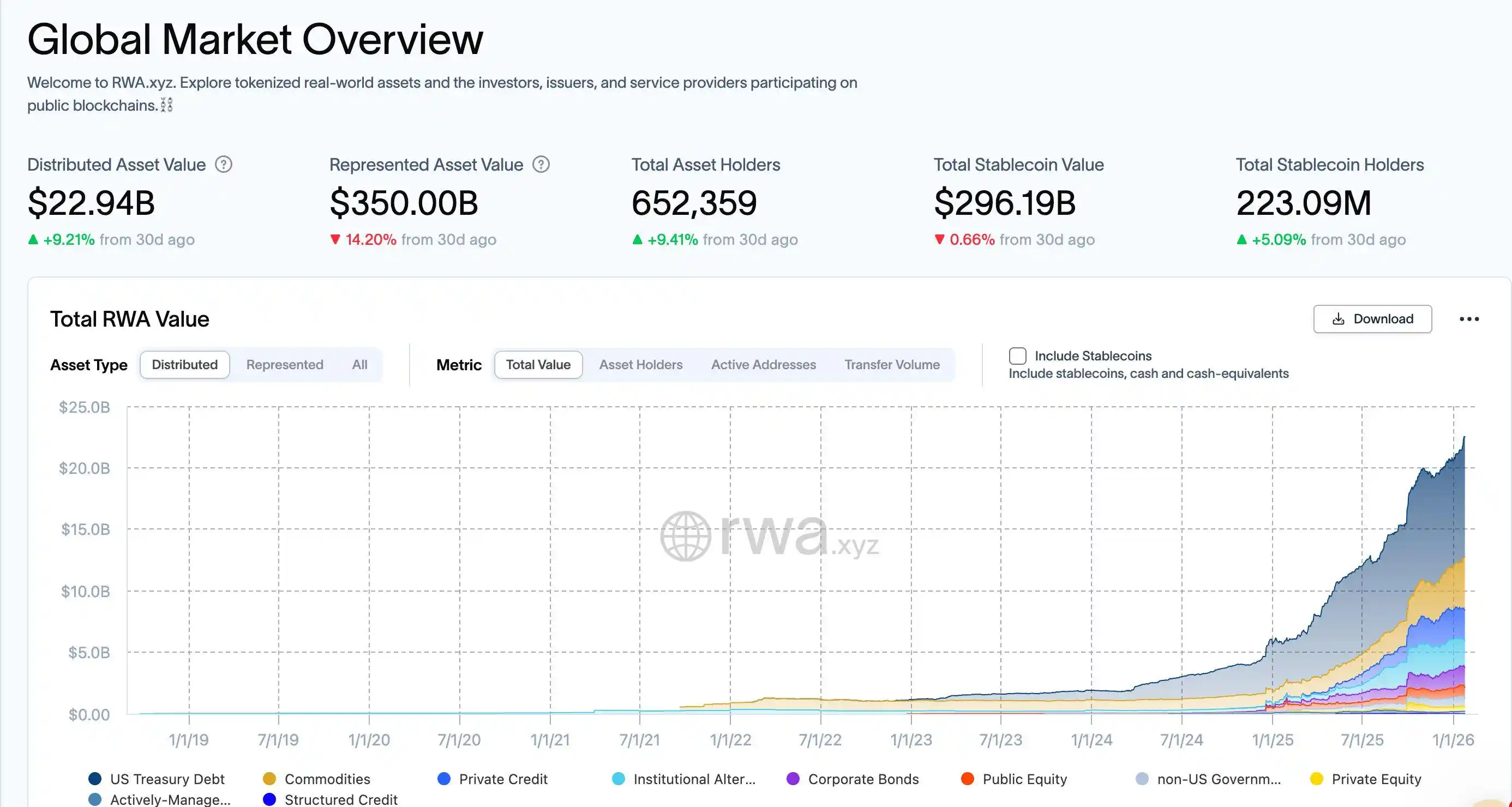

As of mid-January 2026, according to statistics from rwa.xyz, the total scale of RWA has climbed to $22.9 billion, a significant increase from $19.22 billion in mid-November 2025. In terms of holder structure, industry growth shows stable rather than explosive characteristics. The number of holders increased from about 600,000 in mid-December 2025 to 650,000 by the end of January 2026, a growth of 8%-9% in just over a month. It is worth noting that the number of monthly active addresses has declined after reaching a peak of nearly 100,000 about a year ago, but the total value continues to rise. This performance indicates that RWA is seen as a portfolio asset on the balance sheet rather than a token for high-frequency trading.

Asset distribution and on-chain patterns further highlight the institution-dominated nature. In terms of on-chain value locked, Ethereum holds an absolute dominant position, with RWA value of about $13.6 billion, accounting for about 60% of the total global on-chain RWA scale. BNB Chain follows with $2.3 billion, while Solana and Liquid Network have $1.1 billion and $1.5 billion, respectively. Stellar joins the main camp with $1 billion. Clearly, RWA assets favor payment chains with predictable execution, well-developed regulatory tools, and institutional custody support. Value ultimately aggregates in scenarios with the lowest settlement risk.

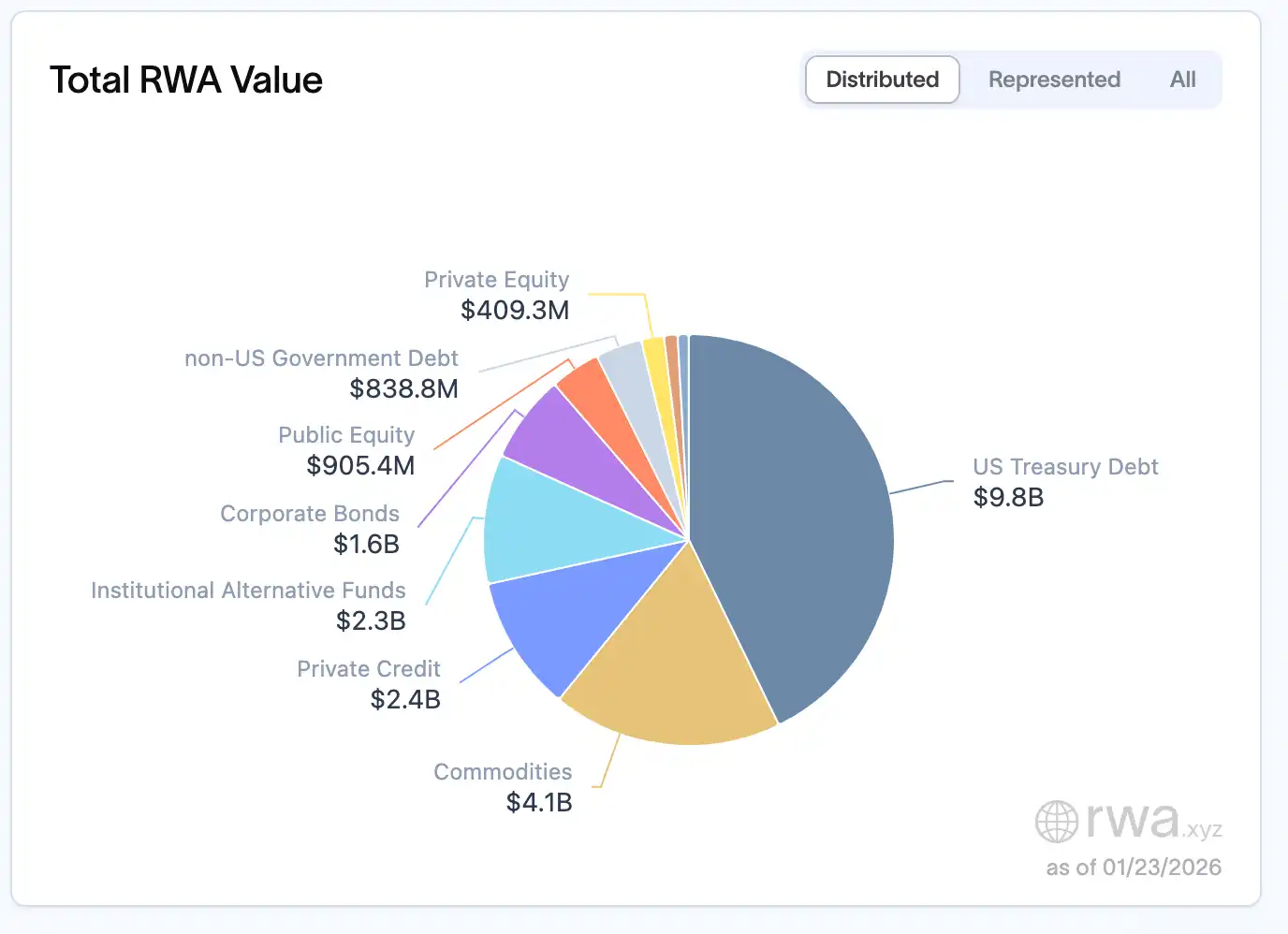

In terms of asset classes, U.S. Treasury bonds remain the core pillar, with a scale of $9.8 billion, accounting for nearly 45%-50% of the total market, becoming the main entry point for institutions entering on-chain investments. Commodities rank second with $4.1 billion, among which gold-backed tokens (such as Tether's XAUT coin) are the core targets. Private credit has a scale of $2.4 billion; although the base is small, growth is rapid, accounting for about 20%-30%. Institutional alternative investment funds, corporate bonds, and public stocks are about $2.3 billion, $1.6 billion, and $900 million, respectively, forming the main landscape of the current RWA market. This trend was also confirmed at the industry level at the 2026 World Economic Forum (WEF) in Davos. Tokenization became the core theme of crypto topics at this forum. Related WEF discussions defined 2026 as a "turning point" for digital assets, clearly stating that blockchain has moved beyond the pilot phase into actual production environments. The focus of discussion has shifted from early ideological debates to infrastructure construction, scalability, and enterprise-level deployment.

When RWA Becomes Part of Financial Engineering

If we look beyond the surface of scale growth and institutional entry and deeply analyze the asset structure of RWA, we will find a clear and realistic trend: the current growth of RWA mainly comes from highly financialized assets. The "Real" here refers more to the compliant on-chain placement of financial assets rather than directly empowering real-world production activities.

U.S. Treasury bonds, money market instruments, repurchase agreements, and commodity funds constitute the main body of on-chain RWA. These assets are not unfamiliar; they already exist in the traditional financial system, with mature risk pricing, highly predictable cash flows, and clear regulatory paths. The role of blockchain here is not to reinvent assets but to provide these assets with an around-the-clock, composable, and automated operating environment. These assets are essentially on-chain "low-risk yield tools," serving three core scenarios: underlying asset allocation for the stablecoin system, efficient management of institutional funds, and interest rate anchoring in the DeFi ecosystem. This layout is essentially an efficiency upgrade within the financial system, a reconstruction and circulation of traditional financial assets on the chain, rather than an extension and expansion of real economic scenarios.

In the current total RWA scale of about $22.9 billion, U.S. Treasury bonds rank first with about $9.8 billion, occupying the largest single category; commodities are about $4.1 billion, among which gold-backed tokens (such as Tether's XAUT) have become the largest single asset in the entire RWA market; private credit is about $2.4 billion, and institutional alternative investment funds are about $2.3 billion. Corporate bonds, public stocks, and non-U.S. government debt are concentrated in the range of $800 million to $1.5 billion. Treasury bonds, money market instruments, and repurchase agreements dominate precisely because they are most easily incorporated into existing risk management frameworks by institutions. They have clear cash flows, extremely low default probabilities, mature valuation systems, and readily available infrastructure in terms of compliance and custody. The role of blockchain here is not to reshape the assets themselves but to reduce settlement friction and improve distribution efficiency.

This characteristic highly matches the core needs of institutions: corporate treasury departments pursue yield and operational efficiency—tokenized Treasury bonds offer 4%-6% returns and support 24/7 access, significantly advantageous compared to the T+2 settlement cycle in traditional markets; private credit instruments typically offer returns significantly higher than traditional fixed-income assets, which is highly attractive to institutions managing huge idle capital; asset management companies use tokenization to reduce distribution costs and expand their investor base; banks focus on building infrastructure under compliance premise. This demand orientation further strengthens the current financialized attributes of RWA.

How RWA Reached This Point

Looking back at the development path of RWA, we can clearly see the phased changes in asset structure, and the core logic behind it is the change in participant structure. The entry of different types of funds directly determines the allocation direction of RWA.

From 2020 to 2022, RWA referred more to private credit, trade finance, and small and medium-sized enterprise loans. MakerDAO channeled on-chain stablecoin funds into real businesses through RWA Vault; Centrifuge tokenized accounts receivable; Goldfinch attempted to build an on-chain credit network without crypto collateral. That was a phase of high yield, high risk, and a strong "real world" narrative, with the core goal of providing financing channels for small and medium-sized entities in the real economy, achieving the connection between on-chain capital and offline production.

The turning point came in 2023. As native DeFi yields systematically declined while stablecoin scale continued to expand, the on-chain world urgently needed a scalable, sustainable real yield support. At this point, market demand shifted. Treasury bonds, as low-risk, stable-yield financial assets, quickly filled this gap: 4%–6% annualized returns, 24/7 accessibility, and T+0 settlement made them an ideal entry point for institutions into the on-chain world. The asset structure gradually shifted from productive assets to financial assets, and the attention of institutional funds gradually increased.

As institutions gradually became the dominant force, the asset composition presented on the chain by RWA also changed accordingly: repurchase agreements gradually dominated among the currently mapped assets, while the relative proportion of private credit continued to decline. This structural adjustment essentially reflects the change in participant structure: when the dominant funds came from the DeFi ecosystem, RWA leaned more towards the private credit model; when institutional capital became the main force, asset allocation naturally concentrated towards Repo.

Repo's Success Also Reveals Its Boundaries

The value of Repo to the RWA industry is undeniable. Its low risk, high standardization, and strong liquidity make it extremely easy to gain regulatory approval, becoming the core carrier for building on-chain financial infrastructure. It perfectly fits the current needs of institutions: it can serve as the underlying asset for stablecoins to provide security support and act as a benchmark for on-chain interest rate anchoring, promoting the smooth integration of RWA with the traditional financial system. It can be said that Repo is the "financial foundation" for the large-scale development of the RWA industry, laying a compliant and stable development foundation for the industry.

But the advantages of Repo are also its boundaries. Repo does not create new economic activities nor improve the availability of financing in the real world. It is more about reducing settlement costs and improving operational efficiency within the existing financial system through blockchain technology, rather than solving "the financing problems of the real economy." In essence, this is a self-circulation of the financial system.

This is not a denial of Repo but a definition of its role. Repo is the financial foundation of RWA but can hardly be the final form. What truly needs RWA is not highly liquid financial assets but productive assets that lack liquidity, have low financing efficiency, yet have real output capabilities.

Infrastructure, energy projects, computing resources, accounts receivable, and private credit all have clear cash flows but are often constrained by the high thresholds and low efficiency of the traditional financial system. What they need is not higher interest rates but more suitable financing structures. The core pain point faced by traditional financial institutions currently is insufficient asset liquidity, so they precisely need the tokenization of such assets to solve it: physical assets represented by solar power stations and real estate have high value but rigid transaction models. The "all or nothing" traditional transaction model limits the efficiency of asset utilization. By tokenizing to achieve ownership fragmentation, the liquidity of such assets can be greatly improved, breaking through the bottlenecks of traditional finance.

In the final analysis, yield is not the purpose but the natural result after the asset is used. Repo's yield comes from the interest rate environment, while the yield of productive assets comes from real demand. When the asset itself is not effectively utilized, no matter how clever the yield design is, it is difficult to sustain.

For this reason, the true value of RWA is not to make already liquid assets liquid again, but to allow assets that were originally illiquid to truly enter the global financial system for the first time.

Compliance Is Becoming the Value of the Asset Itself

As institutional participation deepens, a key shift is occurring in the narrative of RWA: compliance is no longer just a constraint; it is itself becoming part of the value.

Since 2025, clearer regulatory frameworks have become an important catalyst for the accelerated development of RWA. In Europe, after the MiCA regulation came into effect at the end of 2024, it continued to enter the implementation phase, providing clear legal boundaries for tokenized financial activities; in Asia, Hong Kong saw multiple regulatory actions落地 in 2025, such as the Stablecoin Ordinance生效 on August 1, establishing a licensing system for fiat-anchored stablecoins. The government issued a new version of the digital asset policy statement in June, clearly supporting the development of digital assets including RWA tokenization, and promoting digital asset compliance innovation through regulatory sandboxes and pilots. Overall, these institutional advancements reflect the trend of major global markets moving from观望 to scalable implementation.

At the 2026 Davos Forum, tokenization was repeatedly mentioned as a "turning point" for digital assets. The focus of discussion is no longer "whether it should be incorporated into the financial system" but "how to integrate it." Institutions such as BlackRock, Bank of New York Mellon, and Euroclear have already launched substantial deployments in tokenized funds, private debt, and structured products. In this context, there cannot be only roadmaps without assets; only narratives without law; only consensus without structure; only sentiment without rules. The value of future tokens will not only come from market consensus but also from compliance certainty.

At the same time, when the discussion returns to the essence, the core issue of RWA is not in the "on-chain" itself. Tokenization is a technical problem, while the financing structure is the fundamental problem. How assets are priced, how risks are allocated, how cash flows serve investors, how defaults and governance are executed—these structural designs are far more important than "whether there is a token." As the consensus in the industry says: "RWA is not about putting assets on-chain. It's about rethinking how capital reaches production."

Towards 2026: The Next Phase of RWA

Looking ahead, industry consensus is gradually converging. On the asset side, it will shift from financial asset dominance to深耕 productive assets, with computing assets, infrastructure income rights, and commodities becoming new growth engines; on the product side, it will upgrade from single tokenized products to structured financing models to meet the risk and return needs of different entities; on the narrative side, it will shift from a单纯 yield narrative to risk transparency and governance optimization, strengthening the trust foundation for institutions and small investors; on the implementation side, it will move from pilot projects to large-scale applications. As investment thresholds lower and compliance tools improve, the scale of RWA holders is expected to achieve further breakthroughs in 2026.

Despite the rapid development momentum, the RWA industry still faces multiple challenges: asset authenticity and continuous audit mechanisms are not yet perfect; the quantification and control of operational risks lack unified standards, restricting large-scale implementation; secondary market liquidity is insufficient, affecting asset pricing and exit efficiency; legal structures and cross-border compliance have differences, posing obstacles to cross-regional deployment. In addition, at the technical level, cross-chain transaction costs are as high as $1.3 billion annually, the same asset has a 1%-3% price difference on different chains, and the conflict between privacy needs and regulatory transparency remains unresolved. These have become core obstacles to industry advancement.

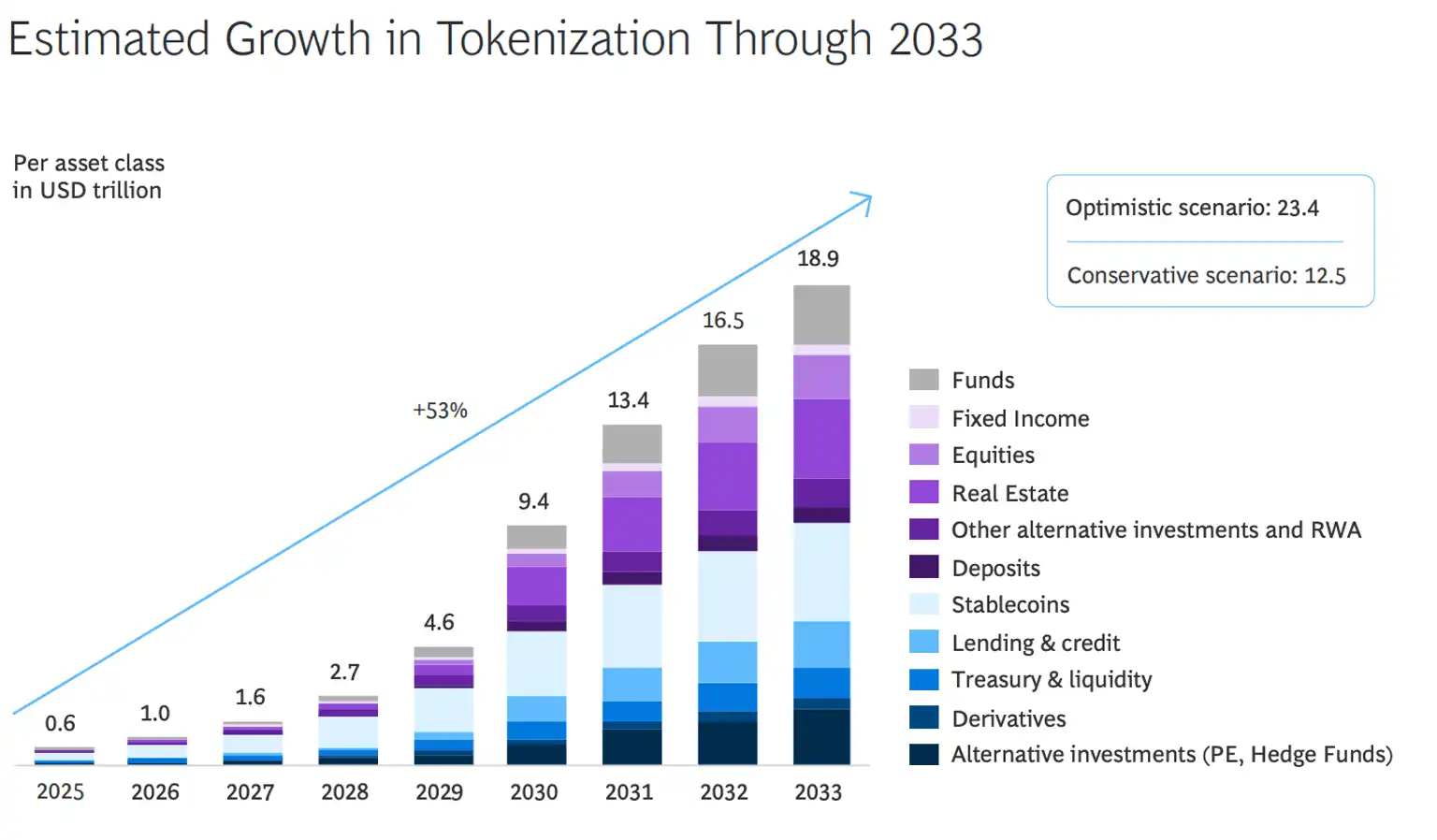

But the direction is clear. As predicted by Boston Consulting Group (BCG), by 2033, the RWA market size is expected to reach $18.9 trillion, with significant industry growth certainty. RWA has become the main perspective for the global financial community to participate in the crypto field. It is no longer a disruptive force but a lasting infrastructure reshaping capital markets. In 2026 and beyond, the development of RWA will no longer be defined by the level of yield but by the depth of integration with real production. Only by rooting in the real economy and activating the liquidity of productive assets can the core value of RWA in reconstructing the connection between finance and production be truly released.